Jsme česká investiční společnost, která rozumí vašim potřebám. Je nám jasné, že jen ve chvíli, kdy lidé rozumí tomu, co dělají, mohou dělat správná rozhodnutí. Dlouholeté zkušenosti ze světa investic a přehledné portfolio našich pěti hlavních investičních fondů vám otevírají cestu k snadnému a bezpečnému investování. Investujeme s vámi. Jsme INVESTIKA.

Připravte se na budoucnost

Sestavte si portfolio podle svých potřeb

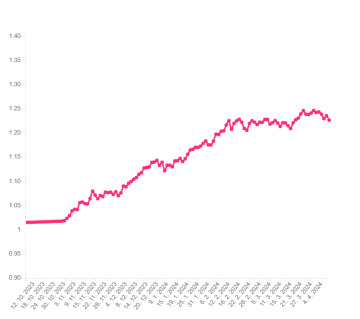

Sestavte si investiční plán přesně na míru svým potřebám a cílům. U každého z našich fondů najdete jednoduchou charakteristiku, která vám pomůže v rozhodování. Pak už je jen na vás, jaké fondy zvolíte k cestě za finanční nezávislostí.

Dlouhodobý investiční produkt

Spoření na důchod, které se vyplatí

Zajistěte si aktivně prožitý důchod bez starostí o finance. Díky dlouhodobému investičnímu produktu (DIP) ušetříte na daních a využít můžete i příspěvek zaměstnavatele. Je jen na vás, do jakých investičních fondů budete investovat, jak často a v jaké výši. Nezapomeňte ale, že čím dříve začnete spořit, tím bohatší důchod si v budoucnu užijete!

Váháte?

Pomůže vám aplikace i specialisté

Na investování nemusíte být sami. Pokud chcete, aby vám s výběrem poradil specialista a nastavil vám vše na míru od A do Z, obraťte se na svého finančního poradce, nebo si ho najděte z řad s námi spolupracujících investičních zprostředkovatelů. Poradce spolu s vámi sestaví finanční plán, který plně zohlední vaši situaci, cíle i toleranci k riziku. Jestliže už víte, jakou investici hledáte, ale chtěli byste vidět černé na bílém, co vám do budoucna může přinést, pomůže vám naše mobilní aplikace INVESTIKA pod palcem.